Fannie Mae My Community Program Guidelines

We understand the financial challenges many homebuyers are facing. They can’t afford a large down payment; may have multiple student loans; or may rely on income from non-traditional sources (i.e., parents or other family members). These challenges can make homeownership seem impossible, or may have impacted their ability to buy a home in the past. After much research and feedback from both homebuyers and lenders, Fannie Mae created HomeReady® mortgage, an enhanced affordable loan designed to meet the diverse financial and familial needs of responsible, creditworthy buyers. Know the Features & Flexibilities HomeReady mortgage addresses common financial challenges and offers expanded eligibility guidelines, such as: • Offering a 3% down payment option. First-time and repeat homebuyers can purchase a home with a down payment as low as 3% of the purchase price.

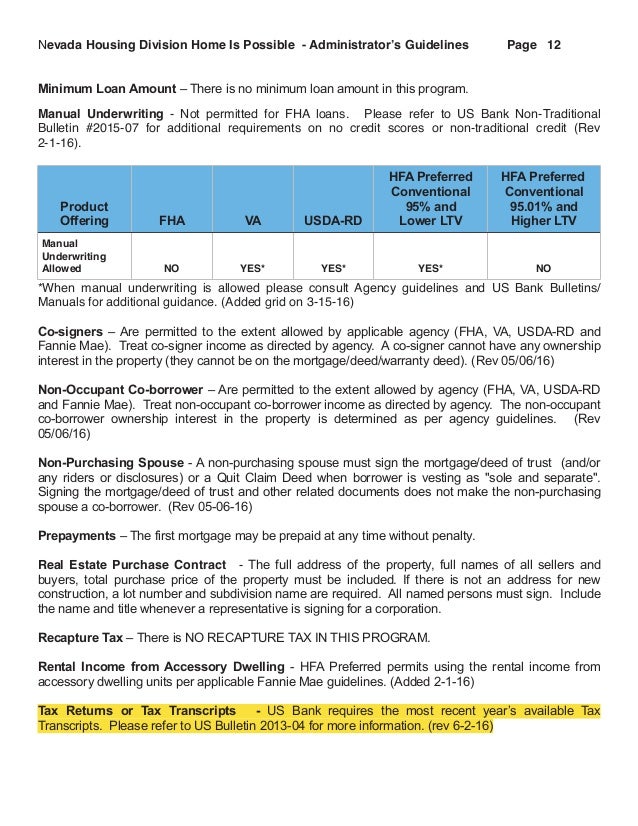

• Allowing co-borrower flexibility. All borrowers do not have to reside in the property.

For example, parents, who won’t be living in the home, can be co-borrowers on the loan to help their children qualify for a mortgage and purchase a home. Income limits may apply. • Accepting additional income sources. Rental payments may be considered as another allowable income source to help qualify a buyer (i.e., rental payments from a basement apartment). Homeownership Education Requirement HomeReady mortgage has a homeownership education requirement to help buyers prepare for the responsibilities of buying and owning a home. Buyers can complete an online homeownership course offered by to fulfill the requirement.

One-on-one homeownership advising (i.e., through a HUD-approved counseling agency) may also be an option for buyers who could benefit from personalized assistance. If you seek one-on-one advising, speak with your lender beforehand to confirm that you’ll meet the HomeReady mortgage education requirement.

Looking to lower your interest rate, shorten the term of your loan or switch from an adjustable-rate to fixed-rate mortgage? If so, refinancing might be the right option for you! When you refinance, you receive a completely new mortgage with new terms, interest rates and monthly payments—the new loan completely replaces your current mortgage. If you have a high-interest rate mortgage, an adjustable-rate loan, or maybe your payments are becoming unmanageable, refinancing may be able to lower your monthly payments, shorten the term of your loan or move you into a more secure loan.

Whatever the reason, there are basically two types of refinancing options available—the federal government’s Home Affordable Refinance Program (HARP), which is designed specifically to help homeowners with little or no equity refinance, or a traditional Refinance. Find out if you’re eligible and which option may be right for you. Cd Crack Program here.

Jul 10, 2011 Fannie Mae (FNMA. Funded in accordance with the requirements for Fannie Mae’s Community Home Buyer’s. In a home-buyer education program. The program is available to all Borrowers throughout the State of Oklahoma, subject to the income limits for the county in which the property is located. This Program Summary is a complement to and not a substitute for the Fannie Mae My Community. Mortgage (MCM) 95 Program guidelines.